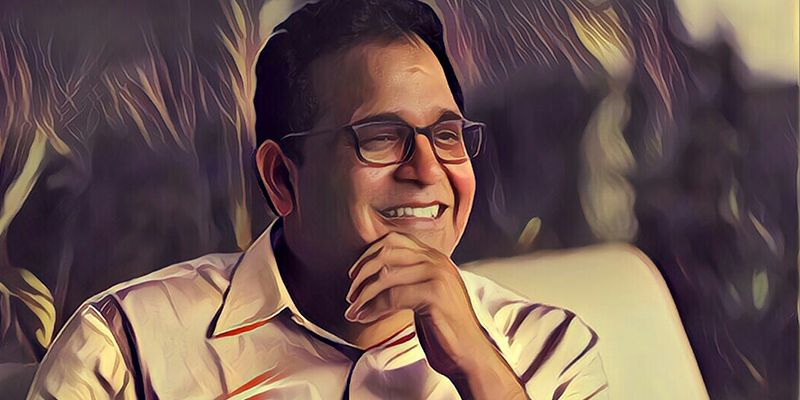

How will Vijay Shekhar Sharma's payments bank really make money?

Vijay Shekhar Sharma’s payments bank business has been the topic of many a recent conversation.

Yesterday, it was reported that the Paytm founder has sold one percent of his shares in One97 Communications for approximately Rs 325 crore. The funds will be utilised for Paytm’s payments bank operations.

Just this past week, One97 Communications, Paytm’s parent company, had issued a public notice that it would be transferring its wallet business, after necessary approvals, to the newly-incorporated payments bank entity. Having got only in-principle approval last year, VSS has 51 percent in the proposed payments bank’s operations.

Although the timeline for the launch of the payments bank remains a mystery, what is clear is that with the licence expiring by March 31, 2017, the company is running out of time.

When asked by YourStory on the sidelines of the Innofest in Bengaluru recently, VSS mentioned two major reasons for this delay.

First was the change in Paytm’s technology plans. The company was planning to build its infrastructure internally but changed track midway. The infrastructure and backend technology will now be powered by Infosys’ digital banking solution, EdgeVerve Finacle.

The second was that VSS was sourcing for capital. Last month, it was reported that, along with One97 Communications, he had invested Rs 220 crore in Paytm Payments Bank (as of November 24, 2016). VSS confirmed to Mint about having invested Rs 112 crore.

Despite these clarifications, he didn’t elaborate upon a timeline, saying only that, “It will be out soon.”

Although payments banks are finally seeing the light of day, their business models remain unclear, especially because the RBI doesn’t allow these entities to lend, limiting them to just payments.

Paytm, however, would like us to believe that it has everything figured out.

The money machine called Paytm

Airtel has been piloting its payments bank in Rajasthan since the last week of November. The hook? Any customer opening a savings account with Airtel Payments Bank will get one minute of talk time (for Airtel-to-Airtel networks) on his/her Airtel mobile for every rupee deposited.

One way for payments banks to make money is to position themselves as wallets and make a buck through transactions. Paytm already claims to have 165 million users who have digitally transacted on the platform, keeping the company ahead of the curve.

Further, what is lucrative for consumers to register for a payments bank account on these wallets is the interest rates offered by the payments bank. Airtel’s payments bank offers savings bank interest rate of 7.25 percent per annum, with a personal accident insurance of a lakh thrown in.

But, Vijay seems clear that he will not be fighting the battle of interest rates to lure customers, as a bigger opportunity lies in front of them.

For Paytm, the real gold mine is data.

On Thursday, Paytm announced its deep integration with India Stack to leverage the platform’s open-stack technology and ensure the best possible experience for its customers and merchants.

It also announced leveraging the power of Unified Payments Interface (UPI), which will allow Paytm Payments Bank’s customers to add money to their Paytm wallets through any UPI-enabled app and transfer money to any bank account from their existing bank account through Paytm’s UPI interface.

Uptake on UPI will not be much of a problem for Paytm either, as it has already gathered a set base of users who transact digitally. This is in contrast to its competitors, who are still struggling to get users to transact digitally, let alone on their platforms.

Also, the open infrastructure of bank-to-bank transfer will be a lucrative option for users, saving them the hassle of transferring money from their bank to their wallet, transacting directly from their Paytm bank accounts instead.

To be activated once the payments bank is launched, this integration with UPI will open up a whole new world of transaction data for Paytm. A spokesperson from Paytm confirmed to YourStory that this data could be used for cross-selling financial services on the platform.

This essentially means that Paytm could become a marketplace (or a third party) of sorts, providing (or deploying) wealth management and insurance services, among other financial products, to its customers. However, until the RBI eases up on its regulations for payments banks, Paytm’s cross-selling will have to be in partnership with certain banks and their products.

These financial offerings are especially lucrative for merchants who have current accounts that fetch them no interest. Having a payments bank will allow them to move further along the curve and opt for wealth management services, helping them feast on a host of other financial products and get better returns on their deposits.

And it will be the transactional data generated from Paytm’s UPI interface which will be the basis for bigger financial entities to cross-sell on the wallet’s platform. For the data provided and the platform, Paytm can charge these financial entities through a percentage split between Paytm and the financial entity whose product is sold.

With a single move, Paytm has opened up newer avenues of revenue for itself.

And no one will be happier than VSS himself with his 51 percent stake, getting to feast on the lion’s share of these revenues or profits at a later stage. He has already claimed in public that he expects his payments bank to start generating revenues in two years’ time.

However, how much of his stake he is ready to sell or dilute to cover the costs of operations remains to be seen.

Lovkesh Kapoor, Head of Investment Banking at Client Associates, a private banking and wealth management firm, says,

Last year, Paytm suffered a huge loss on the whole. This loss can be divided into its e-commerce and payments business as a whole. And we know that e-commerce as business is a capital extensive business. So, now we may see some restructuring happening, as they hive off their e-commerce business from their payments business. But once their payments bank gets activated soon, there might be light at the end of the tunnel in terms of revenues they earn from cross-selling.

Further, sources claim that Alibaba might enter India through Paytm’s e-commerce business, making things easier for One97 Communications in terms of capital.

Hemant Jhajhria, Partner, PwC India, claims that wallets will have to take other routes to make money. He states,

For banks, the more engagement they have with their customers, the more revenues they make. And in case of wallets and other financial technology companies, they already have this customer engagement. And once you have access to these customers, you will have to understand what you can sell more to them. Hence, wallets need to figure out alternate ways of generating revenues and payments banks could be one way for the same. If they don’t, they might be set behind.

Hence, it seems logical for Paytm to go the cross-selling way through its payments bank operations.

However, VSS is clearly looking at the larger picture as he partners with the entire India Stack to become an e-signing authority, facilitate Aaadhar registrations, and leverage the power of DigiLocker.

But how much Paytm Payments Bank will bleed in the entire process before it starts making revenues is a question only time will answer.