How BharatPe floundered a $100M banking opportunity

The digital payments startup had grand plans to evolve from its core fintech product identity and enter the lucrative banking-as-a-service sector. It even had a ready client in Unity Small Finance Bank, its joint venture entity with Centrum. Then the plot unravelled.

Shortly after scored an in-principle banking licence—a significant prize even for entrenched entities—the payments startup saw its valuation vault threefold to $2.85 billion. That jump had to do with more than just the licence.

As BharatPe teamed up with Centrum Financial Services to bid for the troubled Punjab and Maharashtra Cooperative (PMC) Bank, a crucial sub-plot was to create a subsidiary focused on the lucrative banking technology infrastructure market.

The genesis for the fintech startup and the non-bank financial company coming together was to build a digital-first bank, with BharatPe bringing its tech prowess and the Jaspal Bindra-led Centrum Group handling the operations and compliance heavy-lifting.

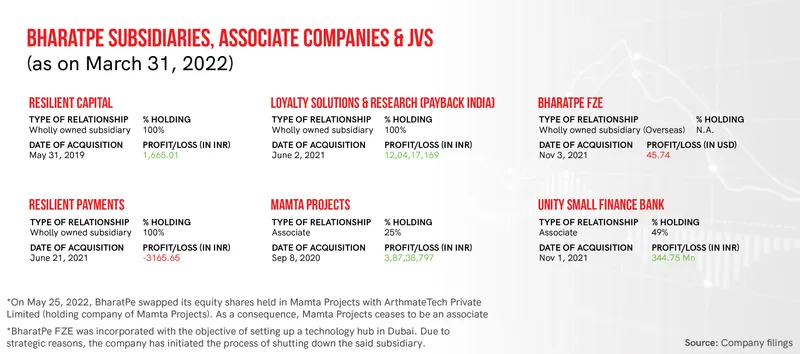

The subsidiary’s first client would be the resulting joint venture entity, named Unity Small Finance Bank (SFB), in which BharatPe has a 49% stake.

The idea was to upgrade the core digital banking infrastructure for Unity SFB and eventually other clients as well, kick-starting a potential $100-million opportunity in annual revenues, according to a former senior executive at BharatPe.

Early last year, though, the Tiger Global-backed startup got embroiled in a series of controversies involving its pugnacious co-founder and former CEO Ashneer Grover, including charges of financial mishandling. Several founding members and senior executives exited the company, inevitably delaying progress on the new tech plans.

Eventually, in February this year, it emerged that Unity SFB had signed up M2P Fintech to upgrade its core banking system, leaving BharatPe in the lurch.

The BharatPe subsidiary, incorporated as Resilient Tech Serv Pvt. Ltd in June last year, is now without a client. Its future remains uncertain, bringing into question BharatPe’s ambitions for a full-fledged entry into the banking-as-a-service sector.

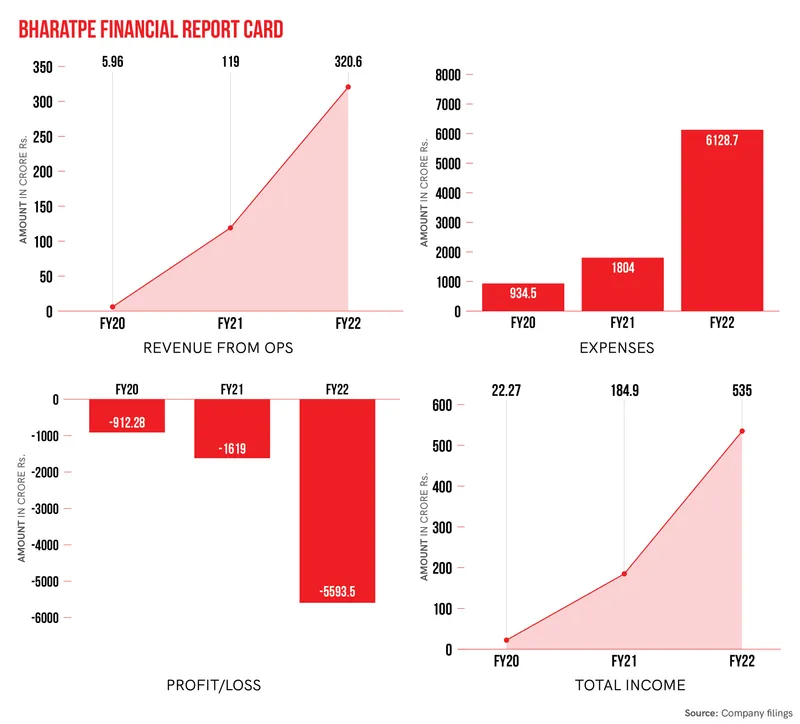

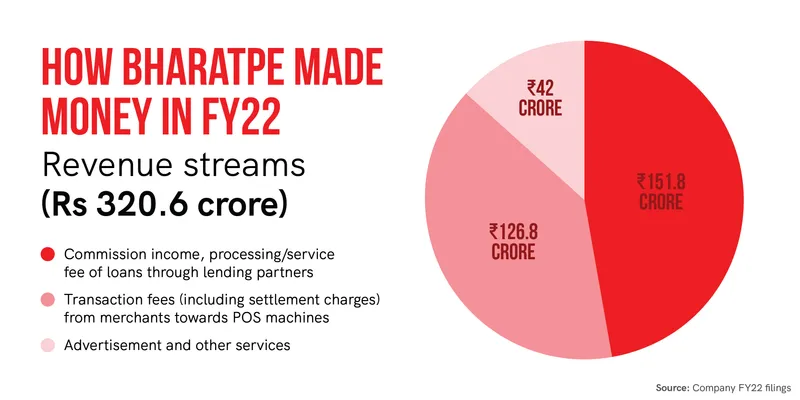

This subsidiary was expected to leapfrog the startup’s business, significantly boosting its revenue from the nearly $40 million it recorded in the financial year 2021-22.

Globally, the size of the banking-as-a-service market is projected to reach $6.9 trillion by 2030, up from $637.40 billion last year, as per Verified Market Research. Future Market Insights projects sales for BaaS platforms in India to rise at a compound annual growth rate of 26% between 2021 and 2030.

A wholly owned subsidiary

Unity SFB began formal operations in November 2021. BharatPe had two tasks at hand—to migrate the operations and customers of Punjab and Maharashtra Cooperative Bank to Unity SFB, and to build the entire digital banking system for the new joint venture entity.

BharatPe’s tech team, then around 60 members and looking to expand, went at the first task with great haste. By March 2022, the team had developed the first version of a mobile application for Unity SFB, inviting customers of PMC Bank to download it and update their profiles.

Beta testing, starting with the user app, was to begin from July, followed by customer verification modules, payments and integrations for a short-term customer credit, or buy-now-pay-later, stack, as per media reports and the source mentioned above.

The team, meanwhile, continued building the core banking and frontend technology for Unity SFB.

Parallelly, BharatPe was working on floating a subsidiary to tap the digital banking infrastructure opportunity, seeking to become a technology service provider for fintech startups and banks, beginning with Unity SFB.

In a regulatory filing last year, BharatPe disclosed it had established a wholly-owned subsidiary called Resilient Tech Serv Pvt. Ltd on June 27, 2022, “with the objective of setting up a technology company developing enterprise-level tech solutions for the financial sector.”

This “subsidiary,” it said, “would develop technology solutions and products for third parties.”

As per an internal document YourStory has seen, teams had been set aside for Resilient Tech, which was meant to steer Unity SFB’s technology services as well.

“Initially, they were looking at transferring people from the main team at (Resilient Innovations Pvt Ltd, the parent company), along with some external hiring,” said the executive mentioned earlier.

In an interview to Business Standard in October 2021, the then BharatPe CEO Suhail Sameer had said the company was in the final stages of building the core banking system for Unity, and that it had been developed from scratch.

“We are ready for the first set of products related to payments and investments and for existing products of BharatPe and Centrum related to lending and SME financing,” he had said.

Controversies and an exodus

Controversy rocked BharatPe in January last year after an audio clip surfaced allegedly of Grover hurling expletives at an employee of Kotak Mahindra Bank over financing for Nykaa’s public share offering.

The incident opened a can of worms. From legal battles and charges of financial fraud, BharatPe’s reputation among investors and the public took a hit.

Several senior executives, many from the tech and product teams, exited. Among them were then Chief Revenue Officer Nishit Sharma and Satyam Nathani, a co-founder who was overseeing the technology integration between BharatPe and Unity.

Another jolt came when Bhavik Koladiya left the company in August last year. Koladiya was the original founder and CEO of BharatPe and had been overseeing tech and product at the company since its inception in 2018. (Koladiya has since sued Grover to recover his shares.)

Geetanshu Singla, who was Vice President-Technology; Chief Technology Officer Vijay Aggarwal; PostPe head Nehul Malhotra; and Rajat Jain, who was Chief Product Officer-lending and consumer products, also quit.

The exodus and the controversies had the effect of stalling work on Resilient Tech, as well as on the banking tech infrastructure development for Unity SFB, sources said. The joint venture entity, under pressure from the Reserve Bank of India to begin digital banking operations, was losing patience.

“Unity didn’t even have net banking service for 12 months. The board had lost patience. It also had commitments to RBI and was under pressure for audits, and needed to move to the new system at the earliest,” said a senior industry executive who had previously worked with the BharatPe tech team.

Unity SFB and BharatPe also reportedly disagreed on who would own the intellectual property rights to the technology being built by Resilient Tech, said the first source mentioned above. “There was an issue over who would own the tech stack,” this person said.

The complete stack, including the final version of the app, was expected to be rolled out by August 2022 for full testing, also serving as the launchpad for Resilient Tech. Critical licensing, including for mobile banking, and partnerships were being closed.

“Negotiations were on with players like Cashfree and Razorpay for (payment) gateway service, Ecom Express for biometric (know-your-customer), Equifax for underwriting, and others for cloud services, analytics, ticketing and chatbot,” one of the sources said. “Some deals were finalised while others were awaiting confirmation.”

Interestingly, M2P Fintech was among the vendors for card integration, said another industry executive closely familiar with these developments. Unity SFB approached M2P Fintech to upgrade its core banking stack instead at the end of August. A spokesperson for M2P declined to comment for this report.

In a statement dated February 15, 2023, M2P Fintech said the implementation entailed the migration of Unity’s core banking system covering 111 branches and serving more than 1.5 million customers. The implementation was completed in 88 days, and all the branches were migrated to the new system on the same day, M2P Fintech boasted.

“Since the controversy blew up, the bank (Unity SFB) distanced itself from BharatPe since they were already dealing with the scandal-hit PMC Bank and couldn’t afford to compound this more with the BharatPe fiasco,” said the industry executive familiar with the developments. “They found a match in M2P, and decided to chart their own path.”

A spokesperson for Unity Bank said in an emailed statement that the company had its own independent growth strategy and that if it entered into business arrangements with either Centrum or BharatPe, those would be conducted at arm’s length and purely on merit. (See complete company response below.)

BharatPe appears to have placed Resilient Tech on the back-burner for now, with the board led by veteran banker Rajnish Kumar focused on sorting governance issues.

The current leadership, under CFO Nalin Negi in an interim role after CEO Suhail Sameer stepped down in January, is said to be focusing on achieving profitability and preparing for an IPO in 18-24 months.

While Resilient Tech would have been a key part of the IPO pitch, multiple executives YourStory spoke with say there is limited possibility for the subsidiary to resume activity in the near future, as BharatPe works on setting certain internal processes in order.

For now, it needs to conserve cash, ride the waves, and steady the ship.

Company responses:

Unity Small Finance Bank

Unity Bank is professionally managed and run by an independent board and management team. Employees of neither Centrum nor BharatPe play any individual role in the operations of the bank. Unity Bank has its own independent growth strategy, which is driven by its competent and independent board. Given the market opportunity, it may choose to enter into business arrangements with either Centrum or BharatPe. However, such an arrangement, if any, will be conducted at arm’s length and purely on merit and will not be on an exclusive basis for either side.

BharatPe

BharatPe is an investor in Unity Bank. We are proud of this association with the SFB and will continue to extend all possible support to the management at Unity, as a responsible shareholder. We would like to highlight that Unity is an independent entity with its own board and management team. The bank takes its independent decisions with regard to any partnerships. These decisions are aligned to the overall growth strategy of the bank. In case BharatPe and Unity Bank decide to engage in a partnership, the same will be done subject to the necessary board approvals at both ends, and executed at arm’s length.

(Cover image and infographics by Nihar Apte.)

Edited by Feroze Jamal

![[Startup Bharat] How Malabar Angel Network is boosting North Kerala’s startup ecosystem](https://images.yourstory.com/cs/2/79900dd0d91311e8a16045a90309d734/MANBuilding1574227798889jpg)