Lacklustre VC funding barely crosses $1B in May; down 47% YoY

The global macroeconomic uncertainties have forced investors to take it slow. In the first five months of 2023, venture capital funding has been uneven and challenging.

For Indian startups, securing venture capital (VC) investment these days is no walk in the park. The funding environment continues to remain challenging, with capital inflow in May barely crossing $1 billion.

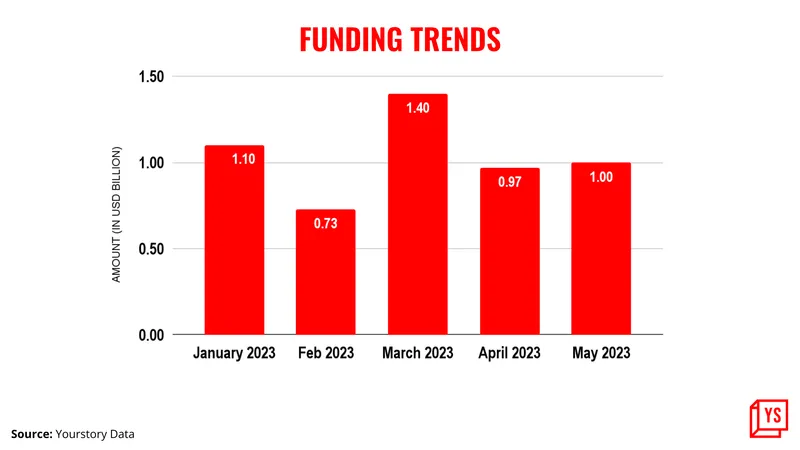

The total VC funding in May 2023 stood at $1.02 billion as compared to $1.91 billion raised in May 2022—a stark 47% year-on-year decline. However, investments managed to surpass the crucial $1 billion mark—only the months of February and April missed the post this year.

The Indian startup ecosystem has been under the grip of a funding winter, with the pessimistic investor sentiment only worsening with the markdowns in the valuations of unicorn startups.

VC funding this year has been inconsistent with fundraising not following a defined pattern and without any sign of a steady upward trajectory in the capital inflow.

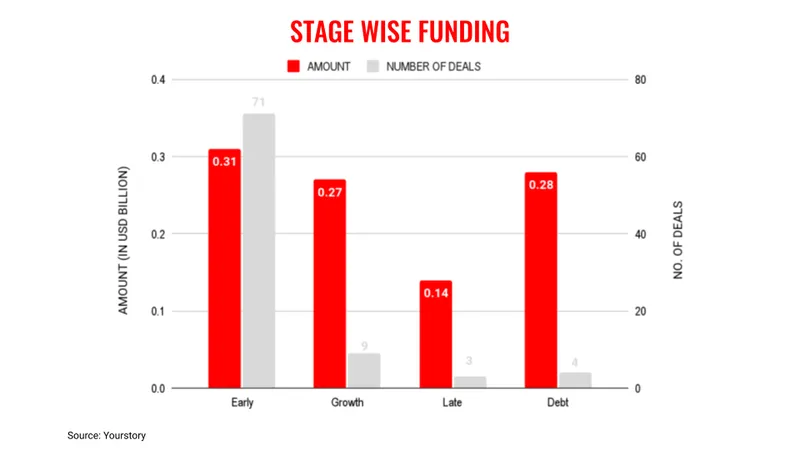

As has been the case for some time, early-stage startups received the highest funding, followed very closely by debt. The emergence of debt as the alternative channel for startups to raise capital hints at the unwillingness of equity investors who are chary of the uncertainty prevailing in major global economies and their impact on India.

In May, only two deals managed to cross the $100 million mark—PhonePe and BYJU'S. The latter, however, funnelled in the money through New York-headquartered Davidson Kempner. Most of the large VC deals for the startup ecosystem are usually in the range of $30 million-$50 million.

In addition, the monthly deal count has also dropped below 100 this year—hovering in the 80s—with the only exception being the month of January when the total number of transactions crossed the 100-mark.

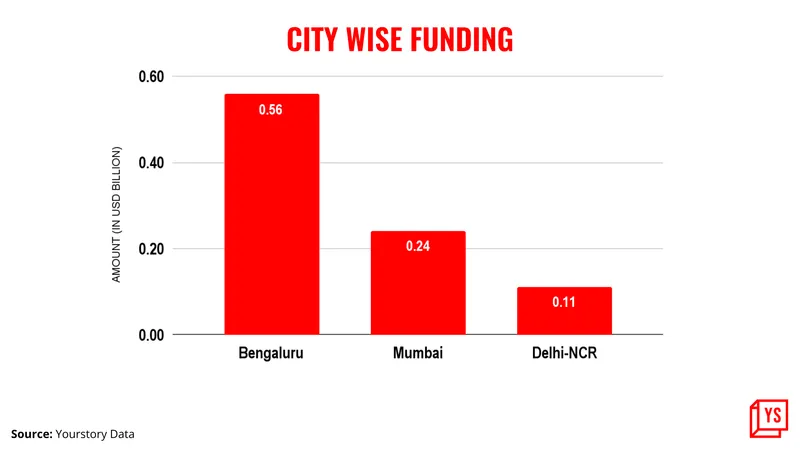

In terms of cities, Bengaluru regained the top spot this month from Delhi-NCR which had been attracting the highest funding for the last two months. The top well-funded sectors in May were edtech and fintech—both fetching large-ticket deals ( and , respectively).

The lack of big-ticket transactions has been the primary reason for the weakened capital flow. Investors are holding on to their purses looking at various troublesome macroeconomic factors like the hike in interest rates by US Federal Reserve, the Russia-Ukraine conflict, heightened inflation, and the slowdown in China's economy.

However, two factors have cast a shadow on the ability of Indian startups to raise capital. The first is the series of valuation markdowns of Indian unicorns by their investors. Companies including , , , , , , , , and saw investors slashing their valuations.

While these valuation haircuts may not cause any serious worry for the startups in running their operations, investors may be forced to think twice before loosening the purse strings.

Secondly, the government’s new notification on Angel Tax regulations has not really helped the ecosystem as new norms for overseas investors do not offer favourable ground to attract investments from certain countries.

Overall, the Indian startup ecosystem is likely to remain financially dry for the remainder of the year, with VCs expected to open their taps the next year. And there's a lot of capital that's waiting to be released, VCs reportedly waiting to deploy an excess of $6 billion.

Edited by Kanishk Singh

![[Funding alert] Healthcare-focused VC firm HealthQuad raises Rs 514 Cr for its second fund](https://images.yourstory.com/cs/2/b87effd06a6611e9ad333f8a4777438f/Image6jb5-1594631569288.jpg)