How ZEE’s Hipi is chasing after the short video market

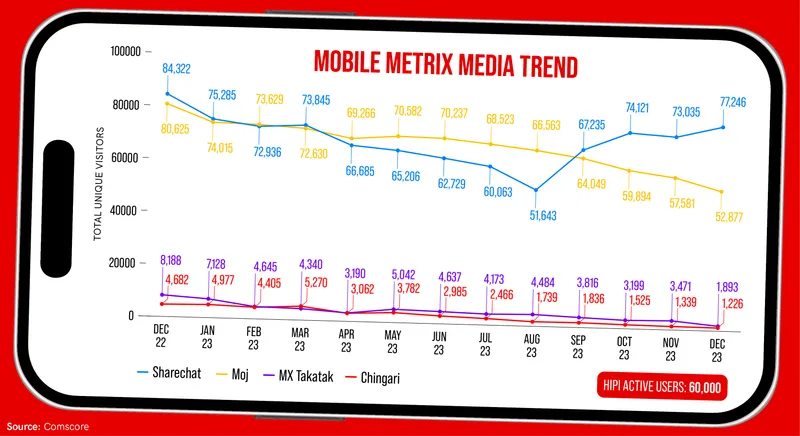

Hipi, which is looking to compete with Instagram Reels and YouTube Shorts, has nearly 60 million monthly active users in India.

Short-form videos (SFV) have been gaining immense popularity in India in the recent years. Home-grown platforms such as Instagram Reels, YouTube Shorts, ’s , , and have become the go-to platforms for people seeking entertainment and engagement.

According to a report by , the industry is expected to reach up to $12 billion by 2030.

Among many players in the short-form video game, Hipi—ZEE’s offering in the short video space—appears confident of its success. Launched in 2020, Hipi was initially part of the ZEE app, and was relaunched two years later as a separate app.

The platform claims to be having about 60 million monthly active users. Between 2020 and 2024, Hipi users grew from 43 million to about 60 million.

On the other hand, ShareChat, one of the largest players in the space, clocked around 505,188 unique users in 2023 compared to a year ago period, where it registered 486,316 unique users, according to data from Comscore. After acquiring Takatak from Times Internet in 2022, ShareChat’s total user base stands at about 250 million.

Infographic credit: Nihar Apte.

Other players like Chingari, with over 40 million monthly active users, and Trell, with around 60 million monthly active users, are not far behind.

However, Instagram Reels and YouTube Shorts are dominating the short-form video market in India, with 2.35 billion and 1.5 billion users, respectively, as of 2023. While these two platforms have higher traction and lead in content volume, Hipi has its own strengths.

GBS Bindra, the Chief Business Officer at Hipi, attributes much of the app’s success to the right blend of entertainment and brand discovery.

Brand discovery and monetisation

At the time of Hipi’s launch, ZEE positioned it as an expansion of its digital portfolio to become an entertainment superapp. Since then, the company has iterated on it, with the latest version integrating a technology that allows discovery of products through the app. Currently, Hipi has varied content, ranging from entertainment to informative videos.

“While you’re entertaining yourself, you're also getting highly inspired through that entertainment… there should be a way for you to be able to discover new products, new brands, and new things while still being in the video,” says Bindra.

In essence, Hipi enables discovery of brands that partner with it, or otherwise, through short video content.

Bindra says, Hipi has been able to crack the monetisation problem right from the get-go by allowing brands to showcase their products through user-generated content. It also pays equal attention to the discovery experience of a brand, while giving users the chance to explore the content they like.

According to him, the discovery of new brands through its content is what sets it apart from other players in the market.

The platform redesigned the app after acquiring Charmboard in 2019, a company that was set up by Bindra, Sushant Panda, and Tripat Preet Singh in 2017. Hipi integrated Charmboard’s backend technology, which now powers a brand-new monetisation strategy that it claims is unlike its competition.

Hipi’s Creator Programme

As per Redseer, short video platforms are a great way for advertisers and brands to get noticed. In India, short-form video platforms are expected to capture 40% of the $8-11 billion video commerce market by 2030.

“Given their cost efficiency, higher rates of engagement, and the sheer density of audiences they cater to, SFV platforms are hard to miss. They typically have higher Click-through Rates (CTR) than other content platforms due to more engaging, shorter, and non-intrusive ads. The higher reach of SFV platforms coupled with lower Costs per Mille (CPMs) lead to reduced Costs per Click (CPCs),” says the report.

But one of the key challenges for several brands is the fact that the format is still new. “Since this is a format that has not been tested, they have questions about whether they will be able to get the performance they are looking for on their investment,” says Mukesh Kumar, Associate at Redseer.

According to Kumar, advertisers have continued to look toward domestic players to increase their visibility, especially in Tier II and Tier III towns in India.

Hipi, on the other hand, is focused on Tier I users. “Because ours is a discovery-based proposition… ultimately if brands are getting discovered on your video, it needs to be discovered by someone who has generally a larger purchasing power,” says Bindra.

This discovery-led thesis is what powers the monetisation strategy for Hipi. Bindra illustrates this with an example of a popular Punjabi singer on the platform. Her video has about 100K views, and plugs an earring. While watching the video, a link to the earring pops up, and each time a Hipi user clicks on the video, both the brand and the creator, if they are part of the creator programme, make money.

Bindra says, under Hipi’s Creator Programme, creators will be able to earn a share of the revenue generated through click-throughs.

“Our sales unit to them is cost per discovery. Let us say, for example, they paid me X amount for a particular discovery, and I will go and share a percentage of that with the creator,” he says.

“A typical ecommerce shop would show you a product as a catalogue… that doesn’t create desire. Through this strategy, we are able to create a desire for the product… and that’s what the marketing team of a brand is interested in… that’s how I create desire for my product,” he adds.

Interestingly, several early-stage brands are also looking towards short video platforms.

Yash Dholakia, an early-stage investor at Sauce.VC, says, “Lifestyle brands would push product launches on reels, maybe also get creators to use their product and showcase it. Since formats like Reels are no longer an opt-in or network-based format, users can continue endlessly scrolling through their discovery page and discover brands without ever having to have followed them in the first place.”

User acquisition

Like illustrated earlier, several domestic short video platforms are struggling or continue to struggle to acquire new users. Bindra says, Hipi has attempted to solve for this in three ways.

One is through leveraging ZEE’s userbase. In 2022 alone, around 80 million people subscribed to ZEE’s OTT platform. “We use that [ZEE’s platform] to educate users about Hipi… we also do integrations with television programming,” says Bindra.

Besides this, the company also uses digital acquisition strategies.

Hipi also targets creators who are struggling to be seen on Instagram. “The algorithms are designed to sell popular videos to more people, and that’s why every algorithm reaches a saturation point. So, we aimed our strategy towards these creators because they were good, but they just weren’t getting discovered on Instagram,” says Bindra.

Hipi has acquired some top creators from Instagram like Chetana Pandey, an ex-reality show contestant on Temptation Island. Pandey, who has 3 million followers on Instagram, has nearly 265.2K followers on Hipi.

Challenges ahead

Building a short video platform isn’t without its challenges. For one, creator monetisation–or compensation to creators–is still a major challenge for most players.

“The current landscape reveals a scenario where only a handful of prominent creators tend to reap the majority of the financial benefits. This concentration of earnings raises concerns about equitable opportunities for the broader community of content creators,” says Rahul Arora, National Sales Head at Rusk Media, a full stack GenZ-first digital entertainment company.

Bindra says they have solved for this through Hipi’s creator programme, which currently has been rolled out to its top 10,000 creators.

Another challenge is retaining creators on the platform. “You need to continue to offer them brand deals and ensure they continue to own and their audience continue to grow,” says Kumar.

Chingari has innovated this through its live one-on-one chat feature, while Roposo has decided to expand its userbase to Indonesia.

For ZEE, Hipi is a key driver, particularly in the User Generated Content (UGC) Market, which is projected to expand at a compound annual growth rate (CAGR) of 29.4% from 2023 to 2030, according to Grand View Research. With its Sony agreement falling through, the company is exploring the opportunity of what it’s like to be a standalone business.

“While our recent performance has been subdued, a large part of this has been due to temporary and transitory factors. The structural strength and attractiveness of the business is still very strong, giving us confidence on our recovery path,” says Rohit Gupta, Chief Financial Officer at ZEEL.

Cover image by Nihar Apte.

Disclaimer: This story has been updated to correct factual errors and typos.

Edited by Megha Reddy