MSMEs riding the wave of high credit availability, yet facing a lending gap in 2023. Why?

Historically, MSMEs have struggled for credit for working capital needs. But in the last 2-3 years, MSME lending has surged prompting these enterprises to avail funds. Nonetheless, the credit gap is still prevalent. Here’s what happened in the MSME lending landscape in 2023.

Lending to the micro, small, and medium enterprises (MSMEs) in India took a front seat in 2023. The surge in loan disbursement sparked a buzz around the demand and supply of credit to MSMEs, making it a prominent theme of the year.

According to SIDBI (Small Industries Development Bank of India), in Q4 FY23, the total MSME credit originations stood at Rs 2.41 lakh crore. By March 2023, commercial loan disbursements witnessed a growth of 1.7X compared to Q4 FY20.

For the digital lending ecosystem, the average increase for loan inquiries during the festive season—between August and November—rose 120% compared to last year. Loan disbursements grew by an average of 60%-70%.

The rising demand and supply of credit shows that MSMEs are adopting formal lending practices and their resilience in business expansion. Nevertheless, the enduring credit gap remains a critical worry for MSMEs.

According to the UK Sinha Committee report of 2019, the overall credit gap within the MSME sector was between Rs 20 and Rs 25 lakh crore.

It aligns with the findings of a BLinc MSME Lending report in 2022 that said the MSME sector's total credit demand stands at Rs 69.3 lakh crore, growing annually at a CAGR of 11.5%. Shockingly, formal lending sources cater to less than 15% of this burgeoning demand.

What happened in 2023

As per the SIDBI report, public sector banks and private sector banks saw credit demand in 2023, clocked 1.3X loan volumes than last year. Credit demand at NBFCs also grew 1.5X over the previous year, and they are rapidly emerging as competitive players in the commercial credit space.

The delinquency rates—the percentage of loans that are past due—have also dropped across all three categories, with private banks clocking the lowest at 1.4%.

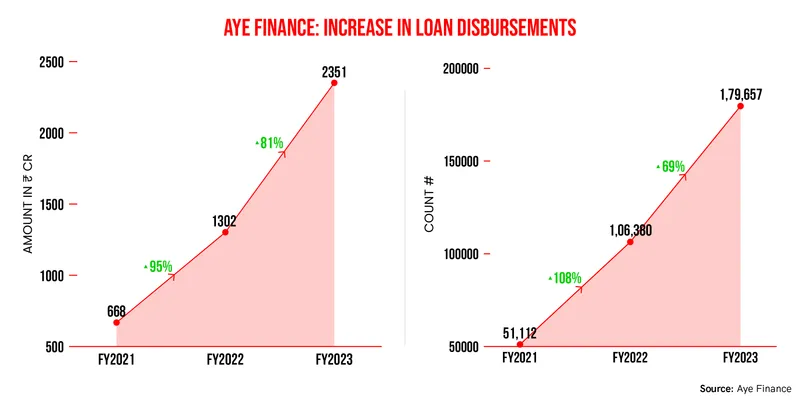

Sovan Satyaprakash, Head of Product and Strategy at Aye Finance, says there has been great traction in lending for the past two years, but lenders haven’t even scratched the surface. Aye Finance is one of India’s largest micro-enterprise lenders.

Aye Finance's increase in loan disbursements

“Access to credit is an old and ongoing problem for MSMEs, and since the deficit is large, even the outflow of credit isn’t matching the pace at which the demand is growing. But, we expect digitisation in lending is on track to tackle this problem,” he adds.

Meanwhile, digital banking adoption has unleashed business potential and facilitated access to comprehensive credit information. The swift integration of digital lending stands as a pivotal driver fueling the surge in MSME credit demand and supply.

Hardika Shah, Founder and CEO of Kinara Capital—a fintech company catering to MSMEs—highlighted the continuous transformation in technology that has enabled secure access to KYC and other pertinent information to assess creditworthiness.

Also, technology is enabling partnerships among ecommerce, NBFCs, and banks, among others, to provide faster access to credit at the point of sale, opening up new opportunities to serve niche credit needs.

“Earlier this year, Kinara Capital conducted an MSME Sentiment Survey, which found that 55% of MSMEs want an instant line of credit to accelerate everyday business decisions,” Shah says.

As per SIDBI, micro enterprises (credit exposure below Rs 1 crore) saw a 23% year-on-year growth in origination value and called for more credit demand. In contrast, small businesses (credit exposure ranging from Rs 1 crore to Rs 10 crore) experienced a mere 1% growth. Further, medium-sized businesses (credit exposure between Rs 10 crore to Rs 50 crore) saw the origination value decline by 19% year-on-year.

Amit Kumar, Founder of MSMEx—an education and advisory platform for SMB owners—highlights three reasons for the staggering rise in MSME lending. The first reason is improved awareness, the second is specialised debt products, and the third is fintech innovations, and it will continue to grow.

“From a $3 trillion economy and 30% MSME contribution, we are moving towards a $5 trillion economy with 40% MSME contribution. Hence, effectively, the $1 trillion MSME contribution will grow double to a $2 trillion contribution in GDP. This will be fueled through various funding sources, debt, equity, or both,” Kumar said.

From VC funding to skill development, the changing face of MSMEs in India

Why is the credit gap consistent?

During a panel discussion at TechSparks 2023 in Delhi, MSME stakeholders discussed new ways of SME financing, and how technology-driven data is transforming it into a digital realm.

Karun Arya, Chief Growth Officer at GetVantage; Mukesh Mohan Gupta, President of Chamber of Indian MSMEs; and Kartik Bakshi, Head of Merchant Lending at BharatPe, highlighted that SMEs were heavily reliant on traditional financing methods.

Gupta said that despite evolving times and technology, challenges persist within the MSME ecosystem. What posed a challenge two decades ago, continues to be a hurdle today. Also, not maintaining transparency in the balance sheet poses one of the biggest challenges for MSMEs to stand uneligible for credit.

Vishwesh Choudhary, Head of Research and Content, Resurgent India—an investment bank and SEBI registered category 1 merchant bank—tells SMBStory that while the credit demand and lending have gone up, the number of MSMEs taking loans have halved.

“The problem of the credit gap is not new, but it aggravated during COVID-19. Now, while we see that lending is increasing, as per our research, the gap remains because the number of MSMEs availing loans has reduced, and that’s mostly because they fail to furnish adequate authentication,” he says.

According to Kinara’s Shah, India has more than 6.4 crore MSMEs and counting, but the vast majority of them remain unregistered, which automatically precludes them from the ambit of formal lending.

“The government’s Udyam initiative has brought a notable shift in this statistic,” she says. India now has 2.15 crore registered MSMEs—a more than 70% increase from the previous year. “Still, there is a long way to go for MSMEs, and especially micro-MSMEs, to seek formalisation,” she adds.

Meanwhile, a huge chunk of lending continues to use the traditional “checklist”, such as property collateral in exchange for a loan, extensive documentation, and long turnaround time on the loans even after approval.

These limitations—combined with the issue of these businesses lacking adequate documents for credit underwriting to be leveraged as security—continue to sustain the credit gap, Shah adds.

“The rate at which the credit demand is escalating surpasses the growth in supply, creating an inability to keep up,” Choudhary highlighted.

The way forward

Sharing insights on the expectations for reducing the credit gap, Kumar says, “The debt underwriting criteria will continue to assess the repayment potential of any business. Unless MSMEs grow their capabilities and improve financial reporting, this credit gap will remain the same as the rate of new MSMEs getting debt will not improve.”

He adds that lending will continue to see growth, as MSMEs play a crucial role in driving economic growth, and that having access to funds is quite important.

Given the extensiveness of the sector, Shah says, India’s economic growth and the sheer ambition of most MSME entrepreneurs, the MSME credit growth trajectory is likely to continue to remain strong, only gaining momentum.

Edited by Suman Singh