Stader Labs is helping users earn rewards by staking crypto across chains

The startup’s platform allows users to stake their crypto easily on networks such as Polygon, BNB Chain, Hedera, Fantom, Near, Ethereum, and others.

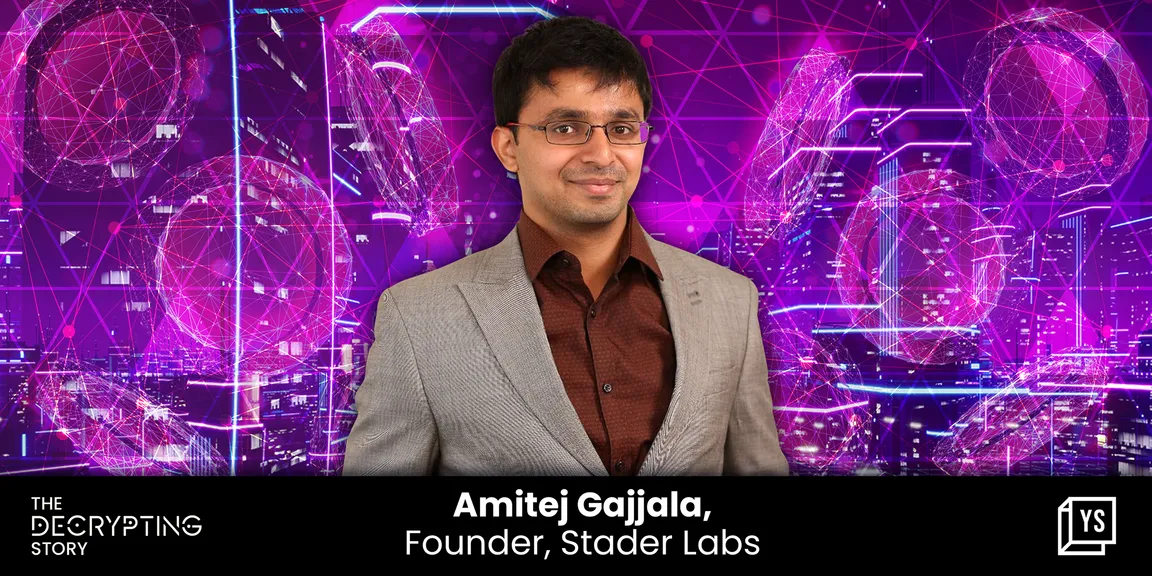

Amitej Gajjala was looking for transformative technologies that could have a wide range of business and social impact when his friend Sidhartha D guided him towards crypto.

Gajjala began exploring various blockchain protocols and decentralised finance (DeFi) applications but realised immediately that he was struggling with crypto staking—a mechanism that helps users earn rewards for holding certain tokens on a blockchain network.

There was no easy way to identify suitable portals for staking and he realised there was a dearth of information on what parameters to consider before staking a certain token on a chain.

“It was not like traditional financial sectors where everything is well-researched. It was unstructured,” Gajjala tells The Decrypting Story.

As the former director and chief of staff of , he had worked closely with founder Sriharsha Majety and was looking for the right opportunity to build his own business.

And with blockchain and crypto gaining favour, along with success stories of Indian-origin Web3 firms such as Polygon, Biconomy and Push Protocol, the path ahead was clear.

In 2021, Gajalla and Sidhartha quit their jobs and began building a staking platform, along with a third co-founder Dheeraj Borra.

The idea was to provide an easy way to stake crypto and earn rewards without complexities on networks such as Polygon, BNB Chain, Hedera, Fantom, Near, Ethereum, and others. Thus, was born.

For the love of staking

Stader’s goal of simplifying crypto staking caught the attention of several Web3 investors and the startup raised $12.5 million last January at a valuation of $450 million.

The round was led by Three Arrows Capital (3AC), with participation from Blockchain.com, Accomplice, DACM, GoldenTree Asset Management, Accel, Amber, 4RC, Figment and several angel investors including Prabhakar Reddy (Co-founder of ) and Matt Cantieri (GM at Anchor Protocol).

And Gajjala adds, “Events related to 3AC and FTX did not have an effect on us because the funds we raised were self-custodied.”

Presently, Stader Labs has more than 70,000 users (with 30,000-40,000 active stakers) who, as of February 21, have staked over $138 million worth of crypto. The total value locked (TVL) on Polygon stood at $51.8 million, $34.38 on Hedera, $10.5 million on BNB Chain, and $9.2 on Fantom, as of March 6.

For Gajjala and the co-founders, the mission is to make staking easy for both new and experienced crypto users.

Another Indian-origin startup Persistence offers crypto staking on its own Layer-1 chain.

Like many other homegrown Web3 startups, Stader is headquartered outside the country—in Singapore. Its founders are based across the US and Canada and its team of 35-40 people is spread across the globe.

“We are decentralised,” says Gajjala.

Global blockchain NEAR wants to bet big on India, transition brands to Web3

Unlocking potential across chains

Stader’s USP, according to the founders, lies in its ability to operate across chains, and not focus on the Ethereum ecosystem from day one.

Having seen a few liquid staking protocols being built on Ethereum, the founders decided to go after other markets on different chains that had “reasonable market cap and high potential for growth” says Gajjala.

While Stader recently began working on an Ethereum staking solution, its focus remains to unlock staking rewards across chains.

“Essentially, users pledge their tokens to a validator so they can participate in securing a network and validating transactions on it,” he explains, adding that Stader does not custody these crypto tokens.

“The tokens become locked, and cannot be withdrawn whenever a user wants. This ensures the security of the network remains intact.”

For end users, staking rewards come from a portion of the transaction fees generated by the blockchain network. Although the staked tokens cannot be withdrawn, users can still access liquidity.

Based on what has been staked, Stader issues a representative synthetic token that can then be used to generate liquidity in secondary marketplaces or as collateral on marketplaces for lending or derivatives.

Institutional staking and other challenges

While Stader’s product has seen traction among individual users, its institutional adoption is slow. Gajjala attributes this to institutions being warier of risks associated with smart contracts on blockchain networks.

“For institutions to start staking, there is a need for several conversations, multiple levels of approvals etc.,” he explains. “They need several teams—such as business, security and risk—to spend a lot of time analysing any staking solution before using it.”

Gajjala’s hypothesis is that fintech institutions are more likely to stake on a solution like Stader. However, the entrepreneur doesn’t rule out social apps and platforms from potentially combining staking reward mechanisms with their existing NFT plays.

In the future, Stader plans to expand into new chains and is actively researching new opportunities to tap into with its staking solution. It also plans to enter new ecosystems such as Solana, Avalanche, and the larger Cosmos network of blockchains.

However, the company faces challenges typical in the world of crypto, especially because it directly deals with crypto assets.

“The high volatility of crypto assets, and the stress it induces, is quite testing. As founders, we need to be mentally strong and focus on building for the long run,” Gajjala says.

The startup also has to ensure robust security and risk management frameworks for its services.

“If a startup puts all its funds in one protocol, it can become insolvent due to something like the FTX bankruptcy. We need to ensure we never place all our eggs in one basket,” he adds.

In terms of matching supply with demand, Stader ensures the issued synthetic tokens are always backed by the staked assets. Further, the supply of synthetic tokens is adjusted based on the supply in the underlying network.

“There's no discrepancy at any point in time. All the data is available on-chain for anyone to verify,” Gajjala adds.

Edited by Saheli Sen Gupta